Assignment: Financial Report Analysis (Partial Exam 1)

Worth: 10 points

Format: Individual or group work

Overview

You will write a 2-3 page financial analysis report about a publicly traded company using their most recent quarterly financial statements. This assignment builds on our Week 5 work with financial terminology and prepares you for translating business documents in your future career.

Remember: This is your first partial exam, so focus on clear communication and demonstrating your understanding of financial concepts we’ve studied in class.

Learning Objectives

By completing this assignment, you will:

- Navigate SEC filing systems to locate financial statements

- Extract key financial data from balance sheets and income statements

- Compare financial performance between time periods

- Write a professional business report in English

- Build vocabulary essential for business translation work

Report Requirements

Structure (2-3 pages, double-spaced)

- Introduction (1 paragraph)

- Name the company and describe what business they operate

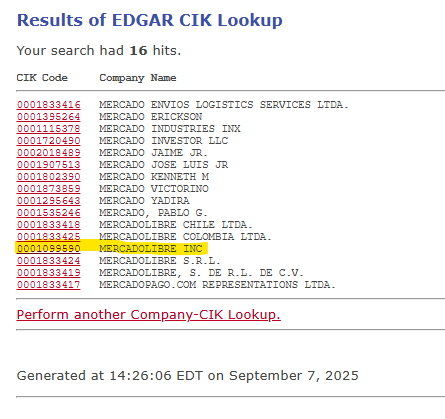

- If the company has multiple entries in the CIK, differentiate the one you analyzed from the others

- Explain which financial statements you analyzed (which quarter/year)

- Balance Sheet Summary (1 paragraph + 1 table)

- Create a simple table showing key balance sheet items

- Compare two time periods (current vs. previous)

- Explain whether assets and liabilities increased or decreased

- Calculate the current ratio (current assets ÷ current liabilities) for both periods

- Income Statement Summary (1 paragraph + 1 table)

- Create a simple table showing key income statement items

- Compare the same quarter from two different years

- Explain whether revenue and profits increased or decreased

- Calculate at least one profit margin (net income ÷ revenue)

- Synthesis of Your Analysis (1 paragraph)

- Based on your analysis, is the company’s financial health improving or declining?

- What does this tell you about the company’s business performance?

- Include one insight from outside research about how analysts view this company

- Conclusion (1 paragraph)

- Summarize your main findings

- Reflect on what you learned about financial analysis

- Connect this to your future work in translation/localization

- Works Consulted

- List SEC filings and any additional research sources

Company Selection

Choose one company from this list. Each group must select a different company.

Available Companies:

- Nike, Inc.

- The Coca-Cola Company

- Nvidia Corporation

- Pfizer Inc.

- The Walt Disney Company

- McDonald’s Corporation

- HubSpot, Inc.

- Xcel Energy Inc.

- eBay Inc.

- Datadog, Inc.

- Netflix.com, Inc.

- Airbnb, Inc.

Alternative Option: You may propose a different company by selecting one that has financial statements available on the U.S. Securities and Exchange Commission website. Companies listed on the NASDAQ may be a good starting point for your search.

Step-by-Step Instructions

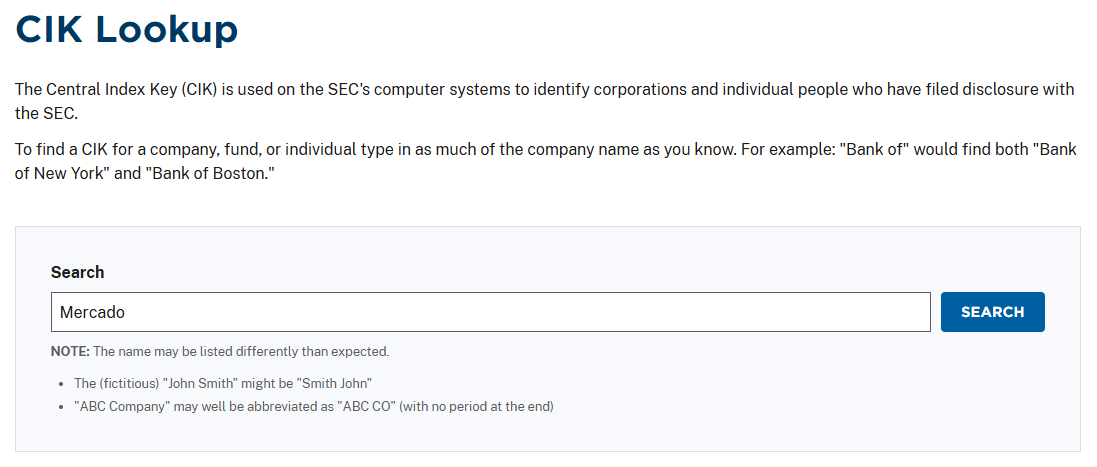

Step 1: Find Your Company’s Financial Statements

-

Go to the SEC CIK Lookup: https://www.sec.gov/search-filings/cik-lookup

-

Search for your company name

-

Click on the CIK code in the results

-

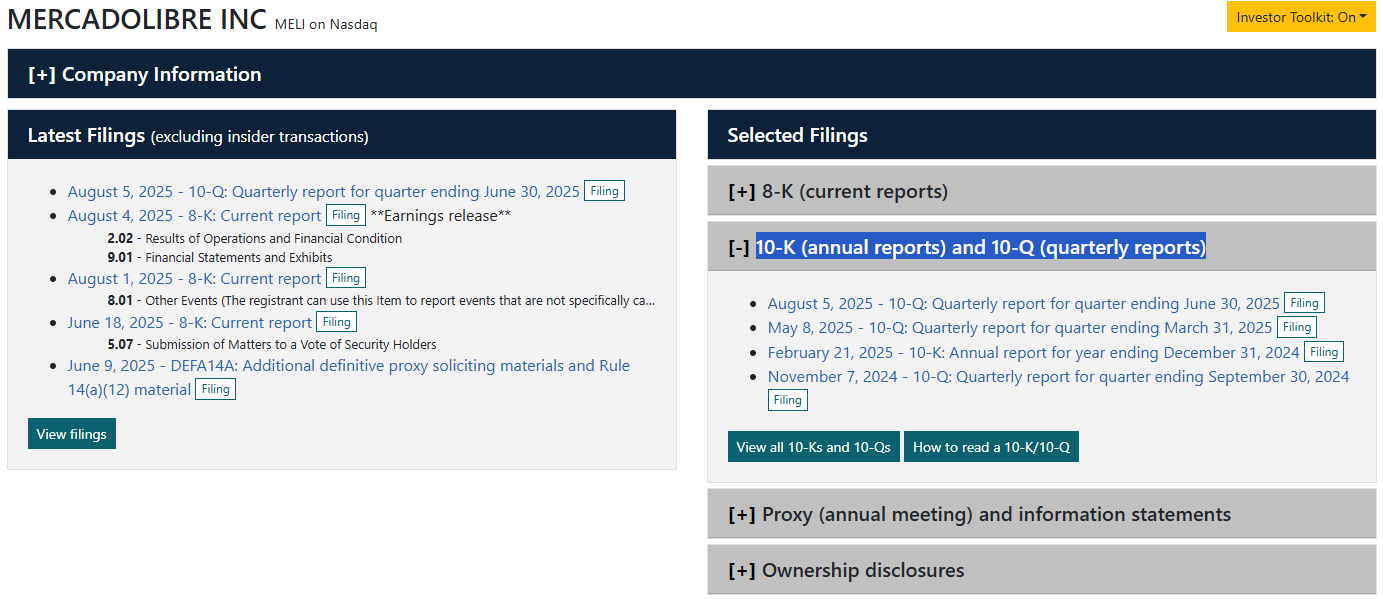

Find the most recent 10-Q (quarterly report)

-

Open the 10-Q and locate:

- Consolidated Balance Sheets

- Consolidated Statements of Income (or Operations)

Step 2: Extract Financial Data

For Balance Sheet - find these items:

- Current Assets

- Total Assets

- Current Liabilities

- Total Liabilities

- Total Equity

For Income Statement - find these items:

- Total Revenue (or Net Sales)

- Gross Profit

- Operating Income

- Net Income

Create simple tables like this:

| Balance Sheet Item | Current Period | Previous Period | Change |

|---|---|---|---|

| Current Assets | $X,XXX | $X,XXX | +X% |

| Total Assets | $X,XXX | $X,XXX | +X% |

| Current Liabilities | $X,XXX | $X,XXX | +X% |

Step 3: Do Basic Calculations

Current Ratio = Current Assets ÷ Current Liabilities

- Above 1.0 = company can pay short-term debts

- Compare both time periods

Net Profit Margin = Net Income ÷ Total Revenue × 100

- Shows what percentage of sales becomes profit

- Compare both time periods

Step 4: Research Context

Look up recent news articles or analyst reports about your company to understand:

- How experts view the company’s performance

- Any major business developments affecting financial results

- Industry trends that might explain the numbers you found

Step 5: Write Your Report

Follow the instructions on report structure above to write a report containing these sections:

- Introduction

- Balance Sheet Summary

- Income Statement Summary

- Synthesis of Your Analysis

- Conclusion

- Works Consulted

Last step: Submit your report

- File Format: MS Word (.docx)

- File Name:

LastNames1_LastNames2_[Company]-Financial-Report.docx(list all team members’ last names separated by underscores)- For example:

Brandt_MartínezWilliams_MercadoLibre-Financial-Report.docx

- For example:

- Due Date: End of week

Remember: This is Partial Exam 1, so be sure you submit polished work!

Example Report Structure

See the MercadoLibre Financial Analysis Example on the next page for a model of:

- Professional tone appropriate for business writing

- How to present financial data in tables

- How to explain financial changes in simple terms

- How to draw reasonable conclusions from data

Assessment Criteria (10 points total)

Completeness (Instructions Followed) (2 points)

- All required sections included in report

- At least one calculation made per statement type (ratio, profit margin) for the correct period

- At least one insight from outside research included (also in Works Consulted)

- File named correctly according to the instructions

Content Understanding & Accuracy (3 points)

- Correctly extracted financial data from SEC filings

- Accurate calculations of ratios and percentages

- Tables and data presented clearly

Communication Effectiveness (3 points)

- Clear explanation of what the numbers mean

- Reasonable conclusions about company performance

- Evidence of understanding financial concepts from class

Professionalism (2 points)

- Well-organized report structure

- Proper grammar and vocabulary usage

- Clear, professional English appropriate for business contexts

📥 Download this Content

Find this file on our repo and download it.

🤖 GAI Study Prompts

Copy the downloaded content and try it with these prompts:

- “Help me turn this screenshot of a balance sheet into an editable table for my report”

- “Explain what [specific financial term] means in simple business English”

- “Based on this financial data, help me understand if the company’s performance is improving or declining”

- “Help me find recent news about [company name] financial performance”

Up Next: MercadoLibre Example Report